As our Data centre cost index reaches its fifth-year milestone, the global construction market finds itself in the midst of an international supply chain crisis and shaking off the impact of a global pandemic. Yet in the face of this adversity, data centre demand is stronger than ever, and 70 percent of this year’s survey respondents believe the industry to be recession proof.

This index report is created by DDA partner Turner & Townsend.

Towards universal data demand

Market growth has been enormous over the past five years, as the internet of things expanded exponentially, and a trend towards a totally digitally connected world was accelerated by 18 months of online working and socialising. As the data centre market matures, the future for the industry looks resoundingly positive. 95 percent of our respondents are confident that demand in 2022 will be even greater than 2021, as opportunities continue to rise across primary, secondary, and now tertiary markets.

Global data centre construction cost inflation

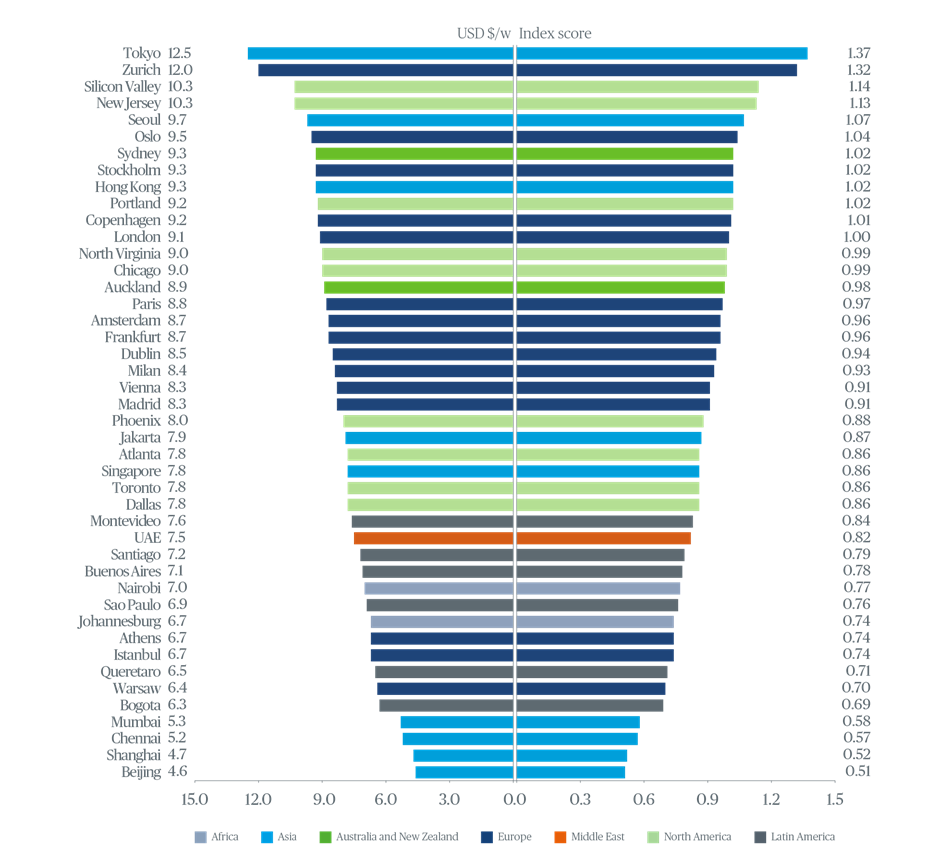

Our fifth Data centre cost index looks at more global markets than ever – 44 locations, up from 40 in 2020, and 32 in 2019. While costs increased by some degree in almost every market in a year of supply disruption and demand growth, most markets were steady relative to other members of the table – with few big leaps or falls.Zurich has given up its traditional position as the most expensive data centre market, as its $12.0/w cost is overtaken by Tokyo at $12.5/w. Tokyo was second place in 2020, but rising construction costs in general, highlighted in our 2021 International construction market survey where it also topped the table, have pushed it into first.

Costs remain high in California’s Silicon Valley and New Jersey – both continuing to share the joint third position at $10.3/w, up from $9.8/w in 2020. Intense market competition in North America means investment appetite is continuing to shift to Europe where it is possible to achieve higher yields and more favourable returns than in the USA. While the traditional Frankfurt, London, Amsterdam, Paris and Dublin (FLAPD) markets remain popular, demand is also rising in secondary and tertiary markets, with new hotspots including Istanbul, Athens and Berlin.

London peaked at fifth place in the table last year, but costs have remained steady at $9.1/w, causing it to slip down the table to 12th place. Its spot has been claimed by two new entrants: Seoul and Oslo – at fifth and sixth with $9.7/w and $9.5/w respectively. These additions mean that Sydney and Stockholm (both $9.3/w), have been knocked down from sixth and seventh in 2020 to seventh and eighth this year. Hong Kong, marked by political tension, makes the biggest upwards cost leap, from 23rd at $7.1/w in 2020 to ninth at $9.3/w in 2021.

Finding value in developing markets

Fresh sources of demand and significant market opportunity can be found in regions where people are approaching the steepest part of the digital adoption curve, such as parts of Africa and South America where the digital market is coming of age and use of internet enabled devices is soaring. In our index, the construction cost per watt has remained relatively flat in Johannesburg rising from $6.6/w in 2020 to just $6.7/w this year, with a similar story in Nairobi rising from $6.9/w in 2020 to $7/w this year; and costs in Sao Paulo have remained on a par at $6.9/w both years.

With less competition – and build costs coming in around a third less than key primary markets – market interest is turning towards developing nations. New locations added to our index for 2021 which are heating up include Bogota in Colombia ($6.3/w) and Montevideo in Uruguay ($7.6/w). For data centre investors and developers looking for higher returns, these nations seem attractive prospects, despite increased risks compared to more developed markets.

Storm clouds on the horizon?

Underneath this sunny picture of rising demand and market confidence, there is trouble brewing. The climate crisis continues to worsen, and these resource-hungry facilities are facing growing pressure to change. The regulatory landscape around net zero is creating new risks, coupled with growing client and consumer expectations.Many data centre leaders are coming forward with climate pledges, with the likes of Google, Microsoft and Equinix signing up to the Climate Neutral Data Centre Pact. Showing willingness is important but achieving these goals will be tough for an industry that accounts for one percent of global electricity use. Only 40 percent of survey respondents believe net zero data centres are achievable in the next five years, with opinion split 50/50 on whether owners/operators have a clear route map to getting there.

Supporting continued global growth to meet the rising digital demand, while also improving the sector’s environmental performance, will take nothing short of a revolution in how we produce and store energy. Careful planning, investment in green technologies and upskilling of the supply chain must all happen at pace and scale to deliver the necessary infrastructure for a new net zero digital world.

Cutting the carbon cost

It is vital that we don’t create a buffer to data centre growth worldwide by failing to tackle the carbon footprint of the sector. But cutting carbon will take a coordinated global effort, a programmatic approach, and transparent, published plans from clients.After five years of increasing the energy efficiency of data centre operations, little more progress can be made in that area. Reductions in carbon footprint must now come from elsewhere.

One key area of opportunity is making construction less carbon hungry. It is still cheaper to build a new data centre rather than convert former industrial space. But there is a growing market for retrofit and the relative ease of conversion, combined with the low carbon tally of retrofit, is why 58 percent of our respondents expect the proportion of conversion versus new build to increase year-on-year going forward. This would be a welcome acknowledgement that we need to understand more about the whole life carbon footprints for data centres.

An area where carbon savings can be made less directly is in the decarbonisation of energy sources. Apart from using buying power to choose renewable sources more readily, we anticipate further investment in battery capacity to be a major focus for the sector going forward. However, there’s growing competition for lithium resources coming from the burgeoning electric vehicle industry.

Overcoming delivery problems

While these new pressures emerge, longstanding challenges for sector around construction and skills capacity remain. 87 percent of respondents to this year’s survey report that material shortages are causing delays to data centre construction, as well as causing costs to escalate.Supply issues, combined with the relentless demand, is causing the construction market in many regions to get too hot, according to 82 percent of those surveyed. With the supply-side crisis showing few signs of cooling off, managing escalating material costs and delays while meeting global demand will take a marked improvement in efficiency and productivity.

Looking off-site

One solution is likely to be standardisation and offsite delivery. For a 30MW data centre, the industry norm used to be 18 months for construction. Now the drive from clients is to complete them in 12, but these timescales are proving unrealistic and are often missed in practice. Modern methods of construction (MMC) are a clear way to unlock progress, yet of our respondents, only 29 percent are seeing MMC widely used on data centre projects.

The issue isn’t a lack of vision, but a shortage of relevant MMC experience and expertise within the data centre market that must be quickly addressed. Clients should learn from other similar industries further along the adoption curve and bring these skills across to the data centre sector. MMC has the added benefit of being a more carbon efficient way to build data centres, so being good for the planet can also be good for the delivery schedule – and can help cool the market.

Managing data centre risk

Tackling these challenges is important to stop them acting as a brake on investment, with both capital expenditure and operating costs under pressure.

Data centre owners need to manage risks to investment, gaining as much certainty as possible of what is being built and when, and getting close to the supply chain to understand capacity and proactively assess possible issues. Building expertise in efficient capital delivery models that deploy modern methods of construction, and reducing operational costs with investment in abundant, cheap, clean energy are the keys to long-lasting change.

There is a green digital future around the corner – and data centres will be at the heart of it. The ‘recession-proof’ industry, with seemingly infinite demand and new emerging markets is fully in-flight, but there’s a long journey ahead. We need to see a concerted effort to get the industry on a path to become more efficient and more sustainable.

Data centre cost index methodology

To generate the results of our data centre cost index 2021, our proprietary cost model was updated. The cost model individually assesses each of the six key capital cost headings: shell and core; equipment; construction labour; construction materials; preliminary costs/general conditions and general requirements; and margin/profit for each of the 44 markets featured.All costs are converted into a single currency, in this case USD, using the foreign exchange rates advised by our economists.

Baseline model assumptions

A greenfield 30MW IT load data centre in the central US region was used as a baseline. It assumed a power density of 3,000W/m2 with a net lettable to gross floor ratio of 1.8.

Shell and core

Our network of regional offices provided parametric costs (per m2) for actual data centre shell and core construction expenses, where available.

Equipment

Actual quoted equipment costs have been applied and factored in as necessary. Additional costs per location are also applied for local sales tax/VAT, import duties and freight.

Construction labour

Our baseline model includes actual construction hours, factored in and categorised by key trade with associated hourly rates from our local businesses.

A productivity assessment table was developed comparing each of the 44 markets for the impact of regulations, skills and cultural/religious variances. We have then applied a ratio of expatriate labour resources anticipated to be involved, resulting in a blended rate.

Construction materials

A material price index was developed using typical material costs in each location, weighted for relevance to data centre construction.

Preliminaries/general conditions and general requirements

Percentage points were added based on our analysis of tender returns, where possible, for relevant projects throughout 2021.

Exclusions

The cost model does not include any client direct costs, land purchase costs, utility works, groundworks, site works, active IT equipment, fibre cabling to support office fit-outs or professional services fees.

Online data centre survey

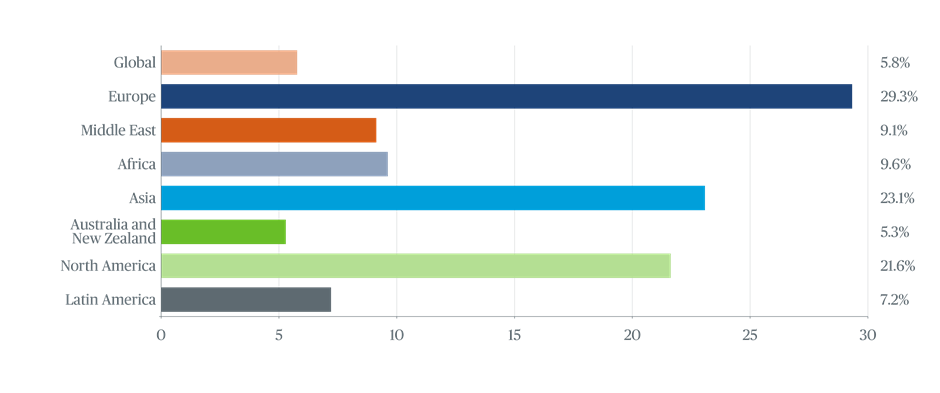

In September 2021, we ran an online survey to gauge the views of data centre sector players on industry trends. We received a total of 208 responses. Our respondents were based in/responsible for the following regions:

Find out more about our data centre cost index:

We are confident that our data centre cost index will become a reliable industry benchmark for those involved in data centre construction. If you’d like to determine an estimated outturn cost for your specific project, or to contribute new market information to our model, please get in touch, we’d be delighted to hear from you.

Global Head of Industrial, Science and Technology